Timing Isn’t Everything

I was in Boise recently visiting with a client family. The Client asked me what to do with a large financial buyout from her husbands firms merger. What’s the right way to place that money so it protects our future was her question?

We then talked about their primary financial success to date was the way they had purchased their real estate. They described it as always selling when others were buying rabidly and buying when others felt they had to sell. My response to her question was – keep doing what they had always done. Put solid econ principles to work – buy low and sell high.

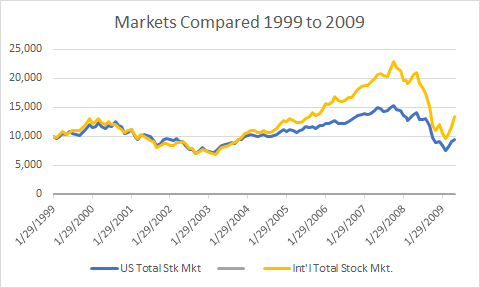

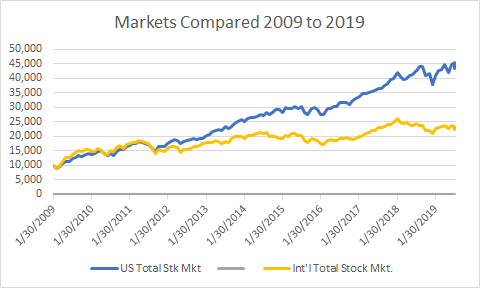

Here is the illustration that shows international holdings outperforming for 10 years and the second US Stocks outperforming for the last 10 years.

The question invariably arises – can’t you just switch over when the assets come together at an equal value? Here is an article that reviews the math of market timing…